![]()

physixfan 2023-06-03 2023-06-03

![]()

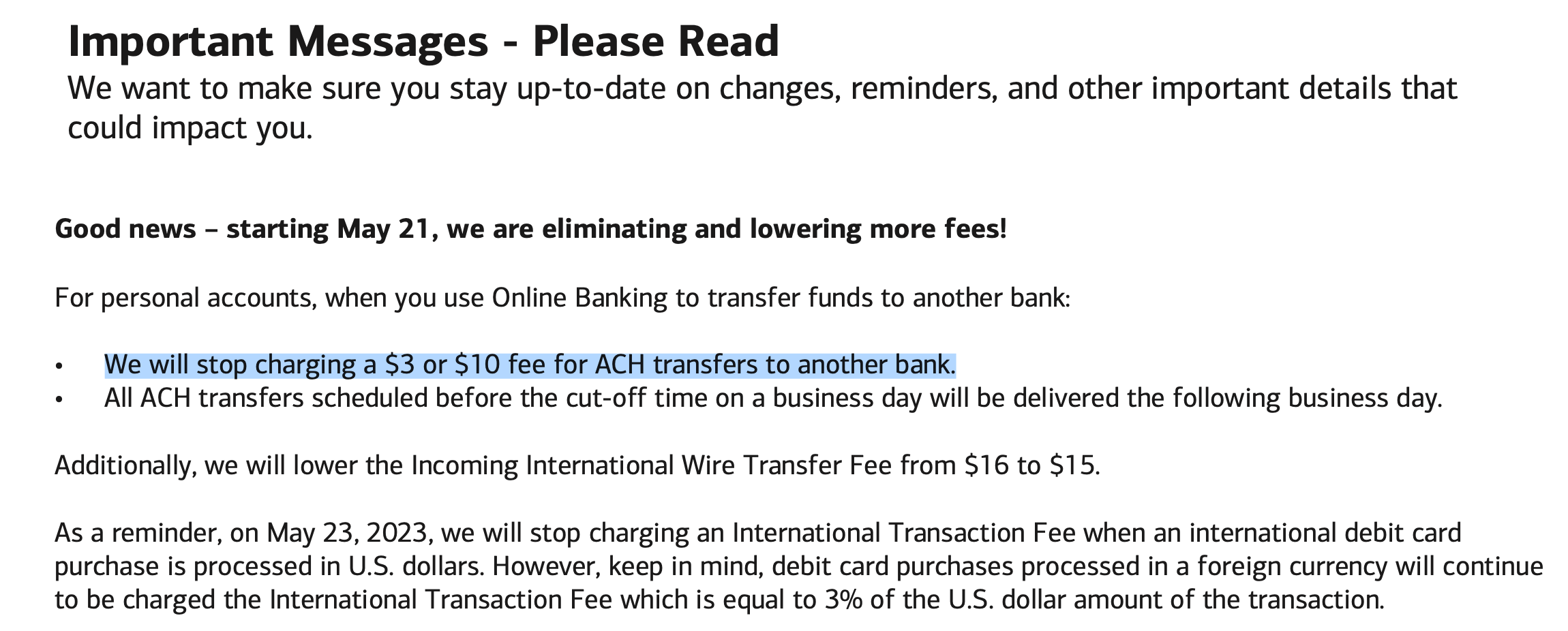

2023.6 Update: Finally, BoA has eliminated the ridiculous ACH transfer fee!

Application Link

Benefits

- New Checking Account Bonus: $100/$300. See below for the requirements to get this bonus. Offer ends on 2023.06.30.

- There is a monthly maintenance fee of $4.95/$12/$25 depending on the type of the checking account. You can avoid this by following the steps below.

- BoA Preferred Rewards program: If you have this BoA checking account, and you have enough assets in checking/savings/brokerage account in BoA or Merrill Edge, you can earn additional points based on the amount of asset. Earn additional 25% rewards if you are in Gold tier ($20k or more in balance); 50% if Platinum tier ($50k or more in balance); 75% if Platinum Honors tier ($100k or more in balance).

- Unlike most other banks, transferring money out of BoA (i.e. ACH push from BoA) has a fee! To avoid this fee, you need to start the transfer from the receiving bank (i.e. ACH pull from other bank). [Update] Starting from Jun 2023, this fee is no longer charged by BoA.

- No early termination fee.

- BoA is one of the largest banks in America, so their branch and ATM network is vast.

Bonus Requirements

- $100 public bonus is for everyone; $300 bonus is really targeted. You are targeted for a higher offer, if you (1) received an email; (2) received a mail; (3) see the higher offer in BoA official site -> “Activity Center” -> “Special Offers & Deals”.

- If you have a BoA checking account in the past 6 months, you are not eligible for this offer. Data points show that if you close an old BoA checking account and apply for a new one after 6 months, you are eligible again for the bonus.

- Direct Deposit requirement: 2 qualifying direct deposits of $250 or more each within 90 days for the $100 bonus; qualifying direct deposits equaling a total of $4,000 or more within 90 days for the $300 bonus.

Different BoA Checking Accounts

- Bank of America Advantage SafeBalance Banking (Formerly BoA Core Checking for Students)

- Bank of America Advantage Plus Banking (Formerly BoA Core Checking)

- Bank of America Advantage Relationship Banking (Formerly BoA Interest Checking)

Here is a comparison and contrast on the official website. The Advantage Plus Banking is the most popular one.

How to Avoid the Monthly Fee (Meet Any One of the Requirements Below)

Bank of America Advantage SafeBalance Banking (Formerly BoA Core Checking for Students): $4.95 monthly fee

- Students under age 24 are eligible to have this fee waived while enrolled in school.

- Enroll in Preferred Rewards.

Bank of America Advantage Plus Banking (Formerly BoA Core Checking): $12 monthly fee

- Students under age 24 are eligible to have this fee waived while enrolled in school.

- Have at least a $250 Direct Deposit each month.

- Maintain a daily average balance of at least $1,500.

- Enroll in Preferred Rewards.

Bank of America Advantage Relationship Banking (Formerly BoA Interest Checking): $25 monthly fee

- Maintain a daily average balance of at least $10,000.

- Enroll in Preferred Rewards.

Summary

Bank of America is the largest retail bank in the US, and many people use it as their primary checking account. The $300 offer is a good one, get it if you are able to set up a direct deposit.

Historical Offers Chart

Application Link

Share this post with friends

If you like this post, don’t forget to give it a 5 star rating!

[Total: 1 Average: 5/5]

Source